Welcome to the home of Crypto price betting

Our real crypto prices are created using a basket of exchange prices with an updated price every second.

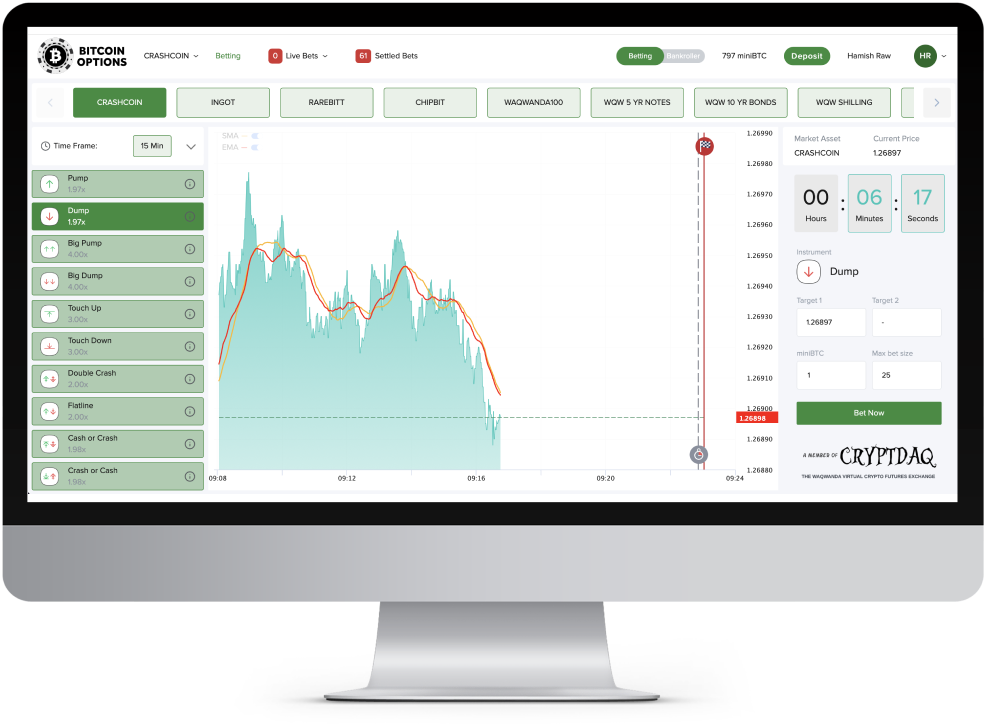

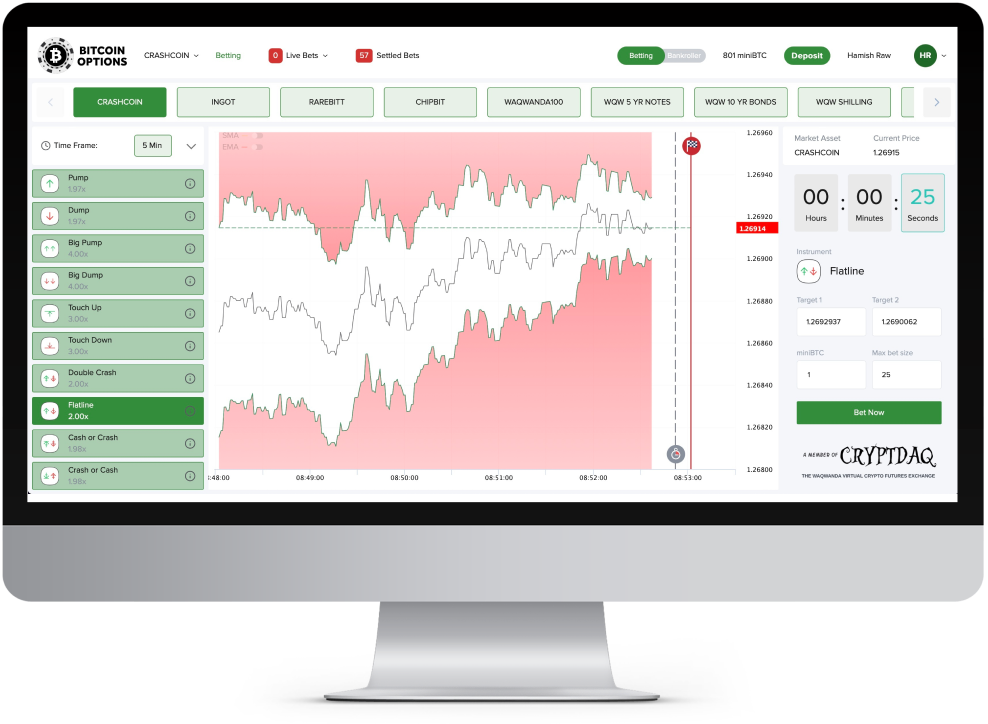

We offer 8 different strategies that the trader can use to reflect their market hunch.

Alternatively, virtual crypto have prices created by a formula which incorporates a PRNG.

Start Betting Now

Bitcoin Options Bet Types

Bitcoin Options provides you with 8 x 2 different type of bets to choose from.

- Pump or Dump

- Hi or Lo Moon

- Hi or Lo Rekt

- In or Out In-Out

- Hit or Miss HiTouch

- Hit or Miss LoTouch

- Hit or Miss Double Touch

- Hi or Lo KIKO

'Pump or Dump' - you bet that the price will be higher, 'Pump', or lower, 'Dump', than the current price at the Finishing Line.

On the left you see two 'Hi' bets with cash out amounts of 1.54 and 1.76. The horizontal blue dashed lines stretching across the screen indicate the target levels.

'Hi or Lo Moon' - you bet that the price will be higher, 'Hi Moon', or lower, 'Lo Moon', than the above target level at the Finishing Line.

The path the price takes to get to the end of the bet is irrelevant.

A 'Hi' bet has been placed close to the end of the bet. You will see the target level over time has got closer to the price in order to maintain a constant probability that the price will be higher than the target level.

'Hi or Lo Rekt' - you bet that the price will be higher, 'Hi Rekt', or lower, 'Lo Rekt', than the below target level at the Finishing Line.

The path the price takes to get to the end of the bet is irrelevant.

Here the trader has bet that the price will stay above the target level for a return of 23.3%. The price has fallen since the bet was placed so the Cash Out is now registering only 0.79, a 0.21 loss if the trader stopped out.

'In or Out In-Out' - you bet that at the Finishing Line the price will be between, 'In In-Out', or outside, 'Out In-Out', the two above and below target levels that straddle the current price.

The path the price takes to get to the end of the bet is irrelevant.

Here the trader has bet 'In' which means that the trader believes the price will be between the target levels at the end of the bet.

'Hit or Miss HiTouch' - you bet that the price will touch, 'Hit HiTouch', or not touch, 'Miss HiTouch', the above target level by the Finishing Line.

The trader has bet that the price will rise to hit the target level before the end of the bet. On doing so the trader receives a 170% profit.

'Hit or Miss LoTouch' - you bet that by the Finishing Line the price will touch, 'Hit LoTouch', or not touch, 'Miss LoTouch', the below target level.

Here the trader has bet that the price will hit the target level which is represented by the horizontal red dashed line. Th price has risen since the bet was placed and Cash Out is now only 0.14.

'Hit or Miss Double Touch' - you bet that the price will touch, 'Hit Double Touch', or not touch, Miss Double Touch', either of the above or below target levels that straddle the price by the Finishing Line.

This is a pure volatility trade. The trader has 'sold' volatility by forecasting that the price would not hit either the higher or lower target level before the end of the Finishing Line. The trader could then cash out or put on a second bet forecasting that the price will hit the new target levels but not hit the outer levels, and hence win both bets.

'Hi or Lo KIKO' - you bet that the price will touch the higher target level, 'Hi KIKO', before it touches the lower target level where you get Knocked Out and lose. OR, you bet that the price will touch the lower target level, 'Lo KIKO', before it touches the higher target level where you get Knocked Out and lose. If the price hits neither the trade is considered a draw.

This KIKO trader has just bet Lo which means they want the price to go down and hit the lower target level. If in the meantime the price rises to the upper target level the trader is KO'd.

Unique Features

Cash Out

Take profits or cut losses at any time. The ‘Cash Out’ functionality is always available providing a real-time estimate of the exit value from your bet.

Multiple Bet Types

16 different bet types on offer with which to take advantage of your market hunch.

Price Formats

Percentage Return (100%), Multiplier (+2.00) or Fixed Odds (‘Evens’) formats are available. Your call!

Bankroller (Coming soon)

Join the Bankroller, stake the 'House' and earn with your BTC.